epf i akaun investment

Register i-Akaun for Employer at the EPF website. Then surf the EPF website to activate your i-Akaun before the expiry date.

General Information Epf I Invest Via I Akaun Principal Asset Management

EPF will e-mail or mail you the details of your Activation Code for confirmation purposes.

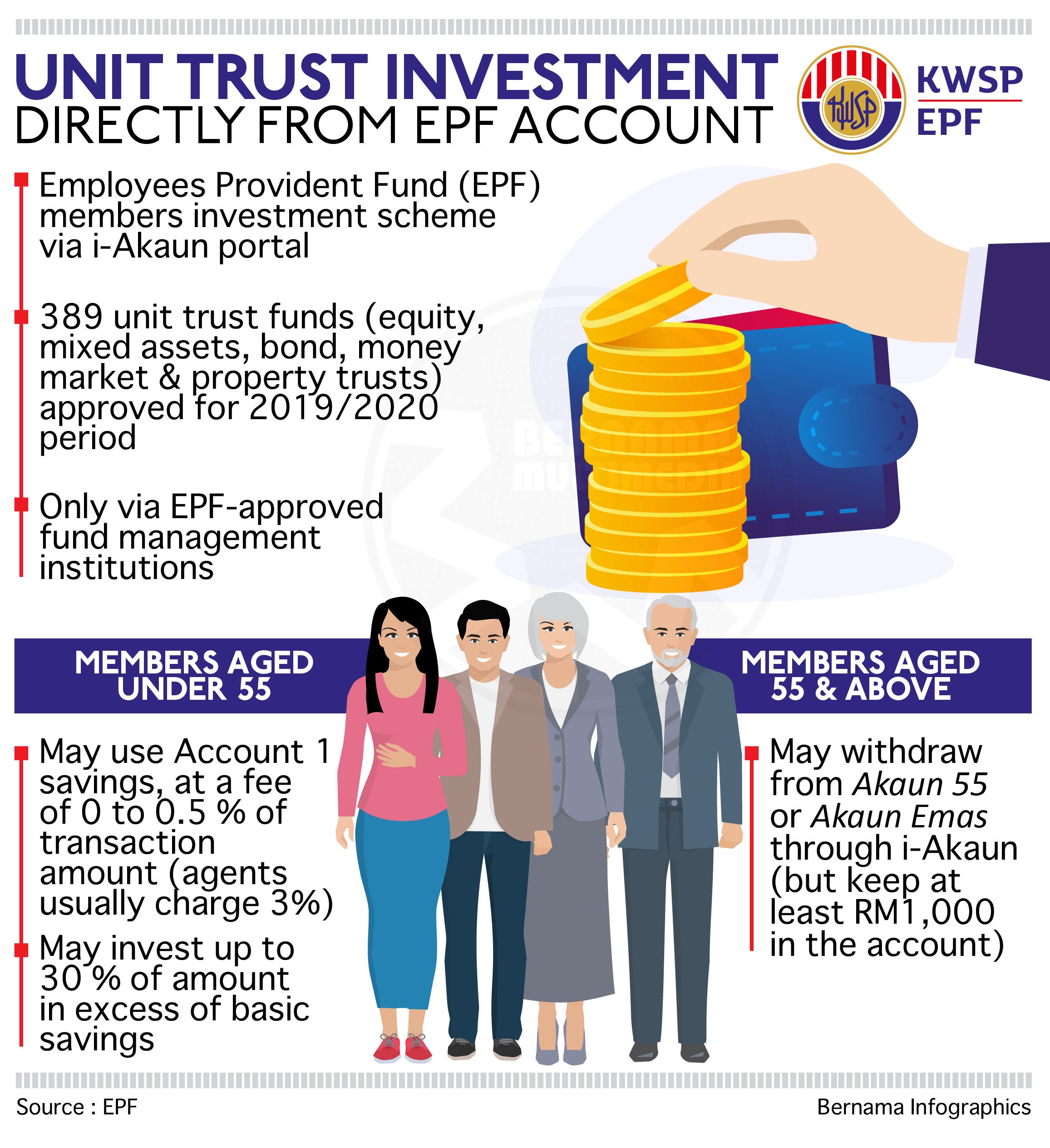

. What are the benefits of investing via EPF i-Invest. The i-Invest portal was first launched back in 2019so that EPF members can conveniently invest their Akaun 1 savings directly into approved unit trust funds provided they meet specified criteria. 9 Landing Page.

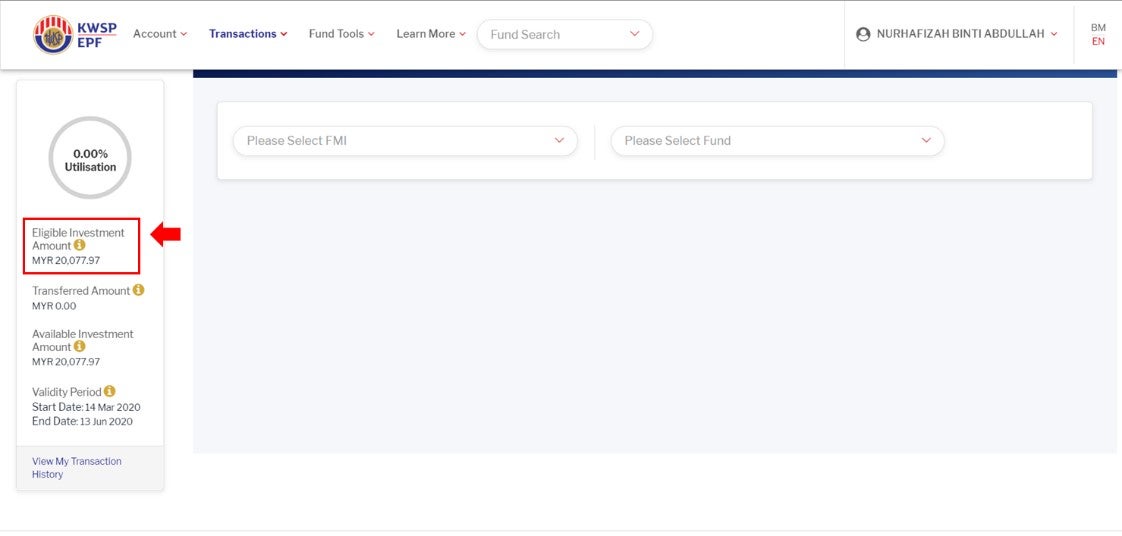

Qualified EPF members can choose to invest into EPF-qualified unit trust funds with fund management institutions IPD appointed under the EPF-MIS. RM50000 - RM35000 x 30 RM4500. So but of course we need to know how to do it and over here Im going to share with you 2 ways of how you can invest your money in EPF.

We are very excited about introducing i-Invest as this digitally powered facility. Investment scheme Information on member investment scheme Information on unit trust investment. How to check if you are qualified.

EPF i-Invest is Employees Provident Fund EPFs self-service online transaction platform which allows eligible EPF members with EPF i-Akaun to invest in EPF-qualified unit trust funds with their savings from EPF Account 1. Server under maintenance please try again later. Eligible EPF members can now benefit from the self-service i-Invest online platform within the EPF i-Akaun member portal.

Menu Search function on EPFs approved funds. The facility is meant to offer members greater autonomy over their retirement savings as well as to simplify the overall investment process. Hey I got no money to invest.

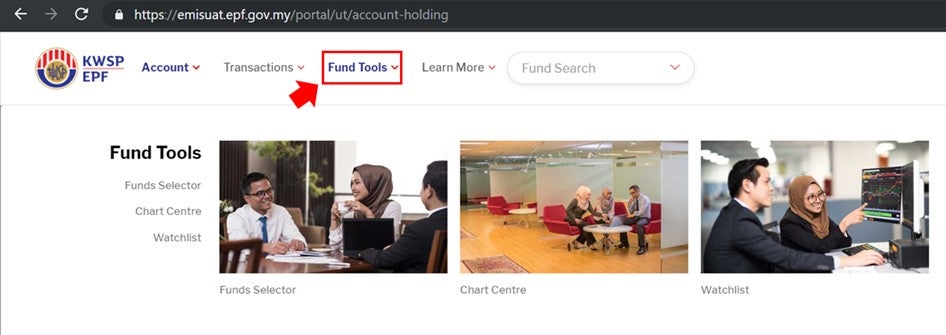

1 Log in to your EPF i-Akaun 2 Select Investment on the menu bar 3 On the buy screen select Principal then choose your fund s You can start investing with RM1000 4 Select Principal as your preferred Fund Management Institution FMI and complete your transaction Start investing EPFs i-Invest Funds. What are the steps to invest in Kenanga Investors funds using the EPF i-Invest. Via EPF i-Invest members of EPF may transfer up to 30 of the amount from their EPF Account 1 in excess of basic savings to be invested in funds approved under the EPF-MIS.

22 rows No upfront fees will be imposed by FMI for investments transacted. Minimum investment is RM1000. Do text us 013-325 7653.

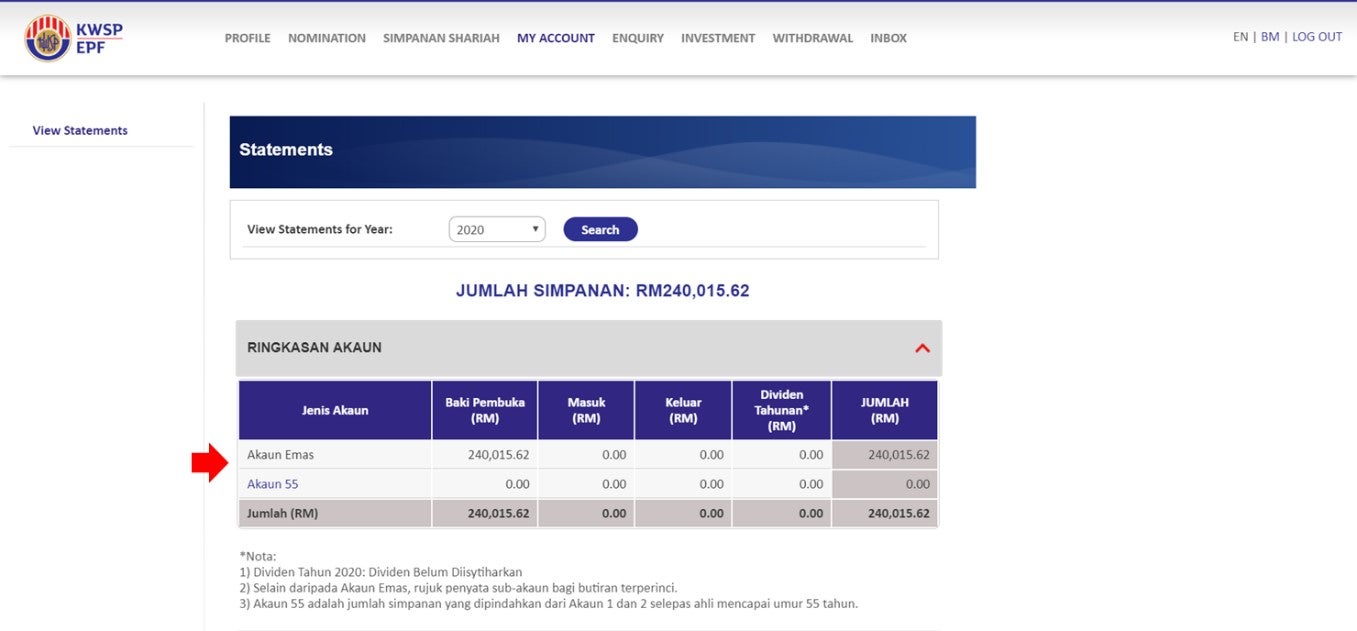

Here is the sample report -it is more comprehensive compared to EPF i-Invest report via i-Akaun. If your EPF Account 1 savings balance is RM50000 the Eligible Investment Amount is. A key element of the online investment facility according to Tunku Alizakri was that sales charges were now practically free as the EPF has enforced a maximum cap of 05 per cent compared to the current 3 per cent for offline and traditional transactions through agents.

You can invest up to 30 of your savings in Account 1 if you have more than the necessary Basic Savings amount. Via i-Invest members can choose to invest in unit trust funds offered by EPF-approved Fund Management Institutions FMIs. First method is doing it.

All EPF members above the age of 18 are eligible to create an investing account. The Benefits of Investing through EPF-MIS How to Invest The amount that can be invested is 30 of the savings in excess of the Basic Savings required in Account 1. If you have already invested RM2000 through MIS within the current validity period the Available Investment Amount is RM4500 - RM2000 RM2500 which is more than the minimum MIS investment amount of RM1000.

Welcome to i-Akaun Member Frequently Asked Question FAQ i-Akaun Member Login. In fact what weve seen is that a lot of people up to 60 to 70 of their assets are tied into EPF. Key in user ID and click Next.

Invest Your EPF digitally with Principal Asset Management via FinAIMS Amelia Hong at 0 sales charge. The i-Invest facility was first launched back in August 2019 and sought to allow members to invest their EPF savings into unit trust funds from approved FMIs directly from their EPF i-Akaun portal. Log into i-Akaun Select Investment tab to proceed Select Transaction and subsequently Buy tab Select Kenanga Investors Berhad on Please Select FMI Select your fund from Please Select Fund Enter amount and select Proceed to checkout.

On your own which is a DIY method right. Written by Tharmini Kenas. Visit any EPF offices together with a copy of the e-mailletter to collect the Activation Code.

EPFs i-Invest in 4 simple steps. Combined with Eastspring Investments partnership and proven track record of award wins 2 members of EPF have the power to control and monitor their own investments. First Time Login Forgot User IDPassword.

Invest for FREE It used to be 3 now is 0. Meanwhile members aged 55 and above can utilise i-Invest using Akaun 55 or Akaun Emas. Log in to i-Akaun Member 1.

Only members up to the age of 55 are eligible for the Basic Savings amount before the EPF issues a release control. The evaluation will in turn assist members in making informed investment choices that correspond to their risk appetites.

Epf Now Lets You Invest In Unit Trust Funds Directly Via I Akaun Portal Soyacincau

General Information Epf I Invest Via I Akaun Principal Asset Management

Eunittrust Com My It S A Matter Of Trust

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf Upgrades I Invest With New Features To Help Members Make Informed Investment Decisions

Bernama On Twitter Epf I Invest Online Platform Enables Unit Trust Investment Directly From Epf Account Https T Co Ld4hsudysn Https T Co 7aqbflb4dk Twitter

Epf I Invest Features You May Not Know About

Rakyat Semakin Terhimpit Rayu Kerajaan Benarkan Pengeluaran Akaun 1 Kwsp Semasa Cari Infonet Logo Finance Free Medical

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube

Epf I Invest Features You May Not Know About

Epf How To Apply For Epf I Invest Mypf My

How Epf Digitalising Its Customer Journey

Epf I Invest Features You May Not Know About

Comments

Post a Comment